Drowning in Liquidity and Greasing Growth Stocks

Q1 | March 2024

Topic: Investments

March 7, 2024

Image used with permission: surangaw (iStock)

Drowning in Liquidity and Greasing Growth Stocks

Q1 | March 2024

After a multi-decade period of being at low levels, inflation picked up suddenly in 2022, reaching a peak of almost 10% in the U.S. and over 8% in Canada in mid-2022. Not too surprisingly, in the lead-up to this point, interest rates were at multi-decade lows and the world was awash in liquidity. Now, we find ourselves in “unusual” economic circumstances and an atypical equity market – maybe we live in interesting times? Much has been written about the Magnificent Seven stocks in the S&P 500, which have produced high equity returns, leading to a very concentrated stock market. Stated more broadly, Growth stocks have easily outperformed Value stocks – not only in 2023, but, as we will see, for about 15 years.

The Grand Experiment

The origins of this go back to the Global Financial Crisis. As we wrote in the aftermath of the GFC, policy makers had a delicate task on their hands: how to reignite economic growth without triggering run-away inflation. “If you can picture central bankers and treasury officials crouched around a smoldering campfire and dribbling gasoline on the damp embers from several massive gasoline drums situated frighteningly close to the fire…then you have pretty much grasped the issue.” Nexus Notes, September 2010.

The gasoline was a combination of fiscal stimulus (more government spending), conventional monetary stimulus (lowering the interest rate), and unconventional monetary stimulus (quantitative easing), collectively resulting in “easy money”. The 2010 Nexus Notes article went on to discuss the risk of a liquidity trap, whereby the high level of liquidity does not actually enhance economic growth, and it pointed out that investors can respond to the liquidity: “Worse than this, major asset bubbles can occur.”

As things turned out, the post-GFC global economy was lethargic, so the policy stimulus continued in many countries for way longer than anyone anticipated. Then, just as normalization started, COVID hit. The policy response to COVID made the pre-COVID extent of easy money look like a swimming pool in comparison to the Niagara Falls that followed. Witness just one aspect of easy money: the U.S money supply spiked to just under US$22 trillion in mid-2022, from its already inflated 2019 level of US$15.5 trillion. We won’t even get started on ballooning government deficits and debt around the world.

The Great Distortion

Free markets are inordinately complex: a myriad of participants individually act to drive ever-changing levels of supply and demand for all kinds of goods and services, the market for each of which is brought into balance by prices. Amongst this chaos (“creative destruction”, as labelled by Joseph Schumpeter in 1942), a thing of beauty emerges – the simplest distillation of the free market is that it serves to allocate scarce resources to their best uses. What is the most broadly applicable price? An item of food, water, oil? No. The interest rate – the price of money – is the grandest of them all. It is the cost of a roof over our heads (the interest rate on the mortgage), the cost of a loan, an entrepreneur’s cost of capital for any investment, the primary determinant of a retiree’s income stream, and the difference between consuming or valuing something today or in the future. So, what happens when the interest rate is artificially manipulated over the 15 years since the GFC? Outside of the Soviet Union, is this perhaps the biggest market distortion experiment of all time? Time will tell and the story isn’t over yet. Putting aside the obvious distortions, such as cryptocurrencies, SPACs and meme stocks, mainstream asset prices have leapt higher – for real estate and equities alike. Within equities, the return from Growth stocks has outperformed Value stocks. In 2023, U.S. Growth stocks returned 42.7% and Value stocks a relatively poor 11.5%. Since 2009, Growth stocks have returned 15.3% per year and Value stocks 10.5% per year.[2] Are Growth stocks the great winners or is this perhaps part of the great distortion?

While Growth stocks offer investors, well… better growth in expected earnings, this comes at a cost, embodied in the stocks’ valuation. The free market teaches us there should be “no free lunch” – if Growth stocks offer better growth in earnings than Value stocks, Growth stocks should cost more, such that the subsequent actual return received by the investor (which derives from these two factors) from Growth or Value stocks should be about the same.[3] As shown above, the return on Growth stocks has well exceeded that of Value stocks since the GFC. The clue as to why is the interest rate. If this has been artificially lowered, then assets that disproportionally benefit from a lower interest rate will do better, at least for some time. As Growth stocks tend to have low current earnings and their higher earnings are expected to occur well into the future, then valuing these future earnings at a lower discount rate (which is the interest rate) has a greater positive effect on the current price of Growth stocks than Value stocks, directly boosting their actual return. This is the theory – in practice, this happens with steroids. Going back to the “worse than this, major asset bubbles can occur” comment, easy money distorts investors’ perspectives. Are investors viewing the future through rose-coloured glasses and, with unbridled optimism, excessively bidding Growth stocks up in value?

The Reckoning?

Today, many growth stocks have good profitability and prospects (eCommerce is thriving and the positive aspects of artificial intelligence are real), so good returns for some are deserved. However, even if a company’s business (as opposed to its stock price) grows profitably for an extended period, that tells one little about its future shareholder return, which is, of course, based on what you paid for the stock relative to its future worth.

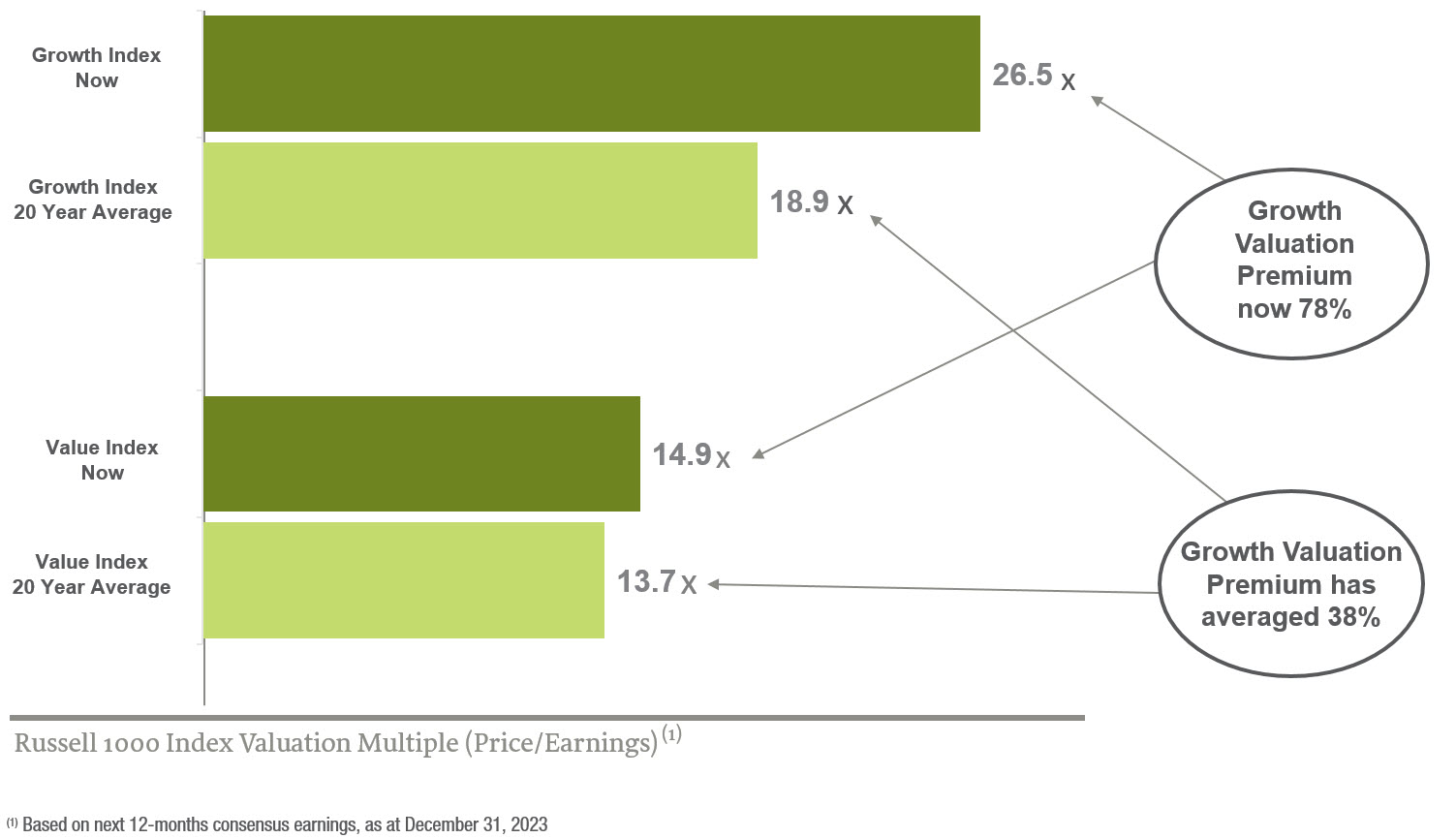

Growth stocks should carry a premium valuation. Growth stocks have traded at a P/E (price to earnings) valuation multiple[4] of 18.9 times earnings, on average, over the past 20 years. This compares to a 13.7 times P/E multiple for Value stocks over the same period. That works out to a 38% valuation premium for Growth over Value. Today, after the recent period of strong returns, the P/E of Growth stocks is 26.5 times earnings, while Value stocks trade at 14.9 times, so investors are paying a whopping 78% premium for Growth over Value, far higher than the historic premium. If shareholders are paying too much for Growth stocks, then future actual shareholder returns will be lower than expected. We have seen this before, such as the “Nifty 50” stocks that cratered in the 1970s and the tech bubble stocks that crashed after partying like it was 1999.

After better returns from Growth stocks, investors become more optimistic. Their collective sense of equity risk declines and they are less concerned about higher valuation multiples. This can continue for an extended period of time and even more so when passive investing is a big component of investing. No passive investor cares, and many are not even aware, that the apparently diversified S&P 500 is now a concentrated high-valuation bet: 32 cents of each dollar of any S&P 500 investor’s money is invested in just 10 stocks that carry a much higher valuation than the average historic valuation multiple of Growth stocks, let alone Value stocks. But valuations matter. Researchers at Vanguard studied how well typical stock market metrics worked as predictors of future equity market returns. Of the 16 metrics they considered, the top two predictors of future returns were two separate measures of valuation multiples. No other metrics proved useful, and earnings growth (whether trend or consensus earnings growth) had zero predictive power.[5]

The Nexus Approach

At Nexus, our primary objective is achieving attractive equity returns over the long term, while controlling portfolio risk at all times. We ensure that our portfolios contain a well-diversified selection of equities comprised of quality companies with reasonable valuations. This disciplined investment philosophy is not always in sync with what is in favour, as is currently the case. We always bear in mind the following:

“In the short run, the market is a voting machine, but in the long run, it is a weighing machine.” Warren Buffet, paraphrasing Ben Graham.

If you don’t care for a dusty quote, the longer-term historic record shows that valuation discipline pays off. Even including the recent period of outperformance for Growth, over the full period since 1927, Value stocks have returned 4.2% per year more than Growth stocks.[6] Now that is something we can take comfort in.

Our belief is that, while many things change in the world, the fundamentals of successful investing stay the same. Sooner or later, in the era after easy money, the gravity of valuation discipline will reassert itself.

[1] To illustrate, a marginally broader group, the top 10 stocks in the S&P 500 collectively had a 2023 price return of 62%, in turn creating an almost unprecedented concentration risk, whereby these 10 stocks comprised 32% of the total S&P 500’s market capitalization at the end of 2023.

[2] As measured by the return on the Russell 1000 Growth Index and the Russell 1000 Value Index (Dec 31, 2009 to Dec 31, 2023), all returns in US$. The Russell 1000 Index includes the largest 1,000 publicly-listed stocks in the United States and these are divided into sub-groups of stocks with higher-growth and lower-valuation characteristics respectively.

[3] Assuming, for simplicity, that the risk of each group of stocks is the same.

[4] These P/E multiples are all based on consensus next 12-months earnings for the respective Russell indices, as summarized by J.P. Morgan Asset Management.

[5] Forecasting stock returns: What signals matter? Joseph Davis et al of Vanguard, October 2012. The study used data from 1926 to 2012. The two valuation metrics were the trailing 1-year P/E and the trailing 10-year P/E. Both are inverse predictors (higher valuation multiples lead to lower future equity returns and vice versa).

[6] Measured as the difference in return of the Fama/French U.S. Value Research Index and U.S. Growth Research Index, in US$, from 1927 to 2023.