The Imperfect Art of ESG

Q2 | April 2022

Topic: Investments

April 8, 2022

Image used with permission: iStock/kokoroyuki

Download This Issue

Download this full issue of Nexus Notes QuarterlyThe Imperfect Art of ESG

Q2 | April 2022

In addition to the devastation, the senseless war in Ukraine has revealed some awkward facts about the composition of some Environmental, Social and Governance (ESG) funds – in particular their holdings of Russian energy companies.

According to research from CIBC, at the end of last year, many of the world’s largest ESG funds had twice as much invested in Russia’s oil and gas companies as they did in Canada’s. The current problem for these funds is that Russia’s biggest energy firms have, on average, lost 85% of their value since the invasion of Ukraine.

This begs the question “Why did ESG funds favour Russian holdings?” The answer seems to be because they had lower carbon intensity, which means the greenhouse gas (GHG) emissions released per barrel of oil equivalent produced are lower. They are large companies, so the absolute quantity of carbon emitted is greater than Canadian companies. But they emit less carbon per barrel produced. It may also be worth noting that Saudi Arabian barrels are less carbon intensive as well. But they come from a country that has received international censure for its poor track record on human rights issues.

This brings us back to an issue we’ve written about previously, that the world of ESG comes with complications. Simple answers to what’s “good” and what’s “bad” are few and far between. Tradeoffs are required.

In this particular case, the tradeoffs made by those investing in Russian energy stocks have not worked well, to put it mildly. It appears that ESG investors sought out the reward of a superior GHG emissions profile, but they were swamped by the risks – now apparent in the harsh light of war – of bad governance and country-level risk in Russia. As the CIBC researchers articulate the situation, ESG “in aggregate, appears to place an overwhelming focus on carbon emissions to the neglect of other social and governance issues… Clearly, the concept of aligning investments with the values and ethics of responsible corporate citizens was significantly outweighed by simple, backwards-looking carbon metrics.”

In contrast, Canadian energy stocks have performed well. On average, the biggest Canadian energy firms (Enbridge, Canadian Natural Resources, TC Energy and Suncor) have gained 20% while their Russian counterparts have fallen 85%.

This is not to say that Canadian energy firms are perfect. They have a higher GHG emissions intensity profile compared to some international competitors. That is an inherent challenge of oil sands operations, leaving their performance in the E part of ESG with room for improvement. But the need to improve has been acknowledged and Canada’s big energy firms have announced a variety of emission reduction targets and underlying plans:

- Enbridge plans to achieve net zero greenhouse gas emissions by 2050, with an interim target to reduce emissions intensity by 35% by 2030.

- TC Energy also targets net zero emissions by 2050, with an interim target of reducing emissions intensity by 30% by 2030.

- Canadian Natural and Suncor, along with other oil sands producers, created the “Oil Sands Pathways to Net Zero” initiative with the goal of also achieving net zero greenhouse gas emissions from their oil sands operations by 2050.

While Canadian energy firms currently are not global leaders when it comes to the carbon intensity of their operations, we anticipate continuous improvement in the years ahead as a result of these plans.

Like all other energy firms, they also face the challenge of managing and reporting on what’s known as “Scope 3” emissions – the GHG emissions that come from the end-use consumption of their products (mostly gasoline and other fossil fuels). This challenge is further removed from each company’s operations, but will need to be addressed. Unfortunately, Scope 3 emissions are beyond the direct control of the energy producer and a material reduction in the emissions that come from our burning of fossil fuels will require participation from all parts of society – individuals, corporations and governments – as well as innovation in clean energy technology.

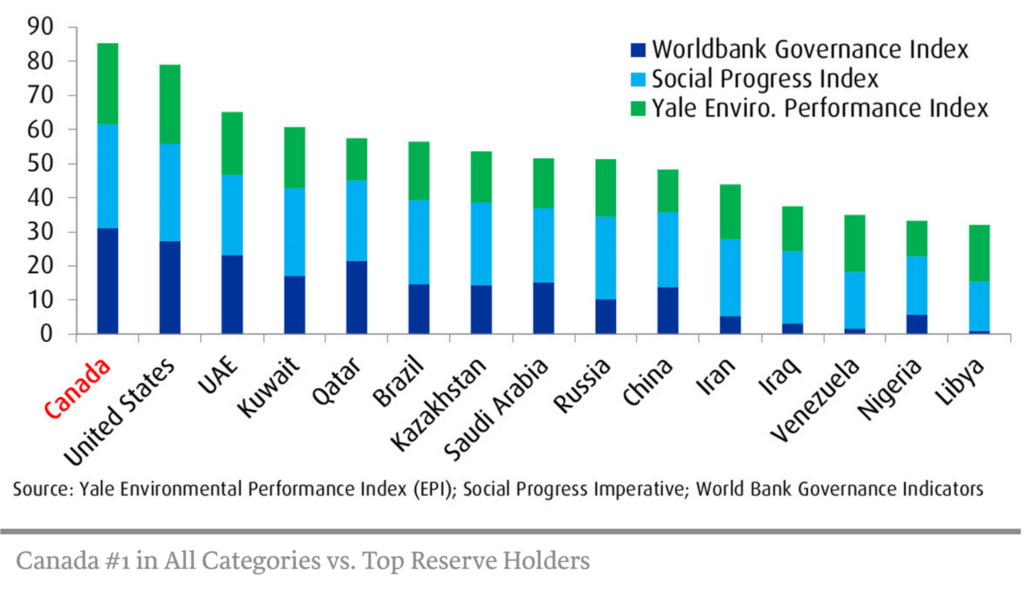

Despite the environmental hurdles, Canadian energy firms do rank better in other ESG categories, particularly those related to social and governance considerations. What’s more, they benefit from operating in Canada – a stable political jurisdiction that ranks well across the board on ESG metrics. While there are many ways to measure our nation’s success on ESG, we find this exhibit from The Bank of Montreal to be illustrative of Canada’s leading ESG position among the world’s top oil reserve holders.

The recent divergent performance of Russian and Canadian energy stocks highlights the importance of each of the E, the S, and the G. Fixation on the E has led to losses for many of the world’s largest ESG funds. Due consideration needs to be given to important social and governance considerations as well. And this, of course, is in addition to the traditional corporate strategy and financial considerations that go into a robust analysis of the merits and risks of an investment. Building ESG into our investment process is at the heart of our approach of “ESG integration” which you can read more about here.

As we’ve written before, ESG analysis and implementation remains a work in progress. Nexus believes strongly in the underlying principles, but we also recognize that ESG is not a silver bullet that can easily solve the complex problems of sustainability. This latest debacle is a clear example how much remains to be done to bring ESG investing into “prime time”. Excellent long-term investment returns result from investing in companies with sustainable businesses. Perhaps what this latest episode suggests as much as anything is that a focus on ESG can’t come at the expense of common sense.

Chart Source: BMO Capital Markets, “Building a Sustainable Future: ESG in Canadian Oil & Gas”, November 2021.