The Hand-Off: Smart Ways to Pass on Your Wealth to the Next Generation

Q3 | July 2025

Topic: Wealth Planning

July 28, 2025

Image used with permission: iStock/ridvan_celik

Download This Issue

Download this full issue of Nexus Notes QuarterlyOn a Side Note…

See another Wealth Planning Nexus Notes Quarterly article that may be of interest to you.

Start Early: Smart Money Moves for the Next Generation of Investors

The Hand-Off: Smart Ways to Pass on Your Wealth to the Next Generation

Q3 | July 2025

Over the years, we’ve helped many clients navigate the wealth planning process. What often feels like the finish line - a completed wealth plan - is just the starting point for the next phase of planning. With a solid foundation in place, the focus shifts to an equally important question: How will your wealth be effectively and efficiently passed on to the next generation?

More Than Just a Will

You might hear terms like estate planning, wealth transfer, or leaving a legacy. All these point to the same idea: intergenerational wealth transfer, or, the thoughtful process of passing your assets to future generations. This can be simple or complex, depending on the value and location of your assets, and importantly, your family’s unique dynamics.

Planning for wealth transfer goes far beyond signing a will. It means:

- Understanding your family’s full financial picture, both today and tomorrow. Your wealth plan gives you the clarity to start these conversations.

- Being intentional about reducing taxes and probate fees upon death.

- Making your wishes unmistakably clear. This includes legal documentation and open communication with your loved ones.

In the sections below, we’ll walk through several key tools, like trusts, joint ownership, and giving during your lifetime, that can help ensure your wealth is transferred smoothly, tax-effectively, and according to your wishes. There’s no one-size-fits-all approach; your plan should reflect your specific needs, values, and family dynamics. Ultimately, the right solutions come from thoughtful planning and collaboration with trusted legal and tax professionals.

Trusts: The Multi-Purpose Tool

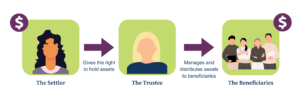

Think of a trust as a financial vessel that comes with clear instructions for how its assets should be used and by whom. It starts with a settlor, who places assets into the trust. The trustee then takes over, managing the assets according to the rules laid out in the trust, always acting in the best interests of the beneficiaries, the people the trust’s assets are intended to support.

This structure offers flexibility and control: you decide when, how, and to whom your assets are distributed. Trusts can also help to bypass probate, reduce tax, and ensure your wishes are carried out with precision. Here are a few more things a trust can help you do:

- Hold property for minors.

- Manage assets and income for loved ones with disabilities, addictions, or diminished capacity.

- Reduce your family’s tax burden by shifting income to beneficiaries in lower tax brackets.

- Ensure certain assets go to a new spouse in a second marriage without risk of a claim from a previous marriage.

These are just a few examples; trusts can do much more. There are many types, each tailored to a specific purpose. That said, trusts come with cost and complexity: setting one up involves legal and advisory fees, and ongoing responsibilities like annual tax filings.

Bottom line: Trusts can be useful tools, but they’re not one-size-fits-all. It’s worth weighing the benefits against the costs to see if a trust makes sense for your situation.

Joint Ownership: A Handy Tool When Used Wisely

Why it Can Work

- Cost Savings: Assets pass directly to the surviving joint owner, bypassing the will and probate process, which helps you avoid probate fees. In Ontario, probate fees are $0 on the first $50,000 of an estate’s value, and then 1.5% on the gross value exceeding $50,000.

- Simple & Speedy: Especially useful for spouses sharing bank accounts or real estate.

- Quick Access: Enables the surviving owner to access funds or property with minimal delay.

Where Things Can Get Tricky

- Tax Implications: Adding a joint owner can trigger capital gains tax. If the co-owner isn’t your spouse, future income or gains may be taxed in your name.

- Loss of Control: Joint ownership often means you need the other person’s consent to make changes, especially with bank accounts or property.

- Unexpected Complications: Adding someone – like your adult child – to a bank account or home might seem like an easy solution, but it can cause unintended issues.

- Unintended Disinheritance: Jointly owned assets like bank accounts or property typically transfer directly to the surviving co-owner upon your death, bypassing your will. This can create issues if it conflicts with the instructions in your will, potentially leading to your assets not being distributed as you had intended.

- Bare Trust Confusion: If you stay in full control of the asset and your child is on title “just to help,” you may have created a bare trust. Even if your child never uses or benefits from the asset, new CRA rules require this to be reported for tax purposes.

Bottom Line: Joint ownership can be a useful tool, but it needs to be used thoughtfully. Always seek advice before adding someone to title or accounts.

Gifting & Giving: The Fun Part!

Gifting: Sharing Assets Now

Gifting assets during your lifetime, or “giving with a warm hand”, is a simple and effective way to reduce the value of your estate, which can lower taxes and probate fees upon death. Even better, you can experience the joy of seeing your loved ones benefit from your generosity in real time.

Before gifting assets, consider:

- Your ability to afford the gift: Once you give a gift, it’s no longer yours, legally or financially. Be sure you’ll still have enough to meet your own needs, now and in the future.

- You can’t gift away your tax liability: The CRA has rules to prevent people from lowering their tax bill by shifting income to family members in lower tax brackets. If you gift assets to a minor child or your spouse, any income (like interest or dividends) earned on those assets may be taxed in your hands.

- The implications of gifting to a married child: Once you gift an asset to your adult child, it becomes their legal property. If they later separate or divorce, that gift may be treated as part of the family property subject to division. To help protect the gift from potential claims in a marriage breakdown, consider the following:

- Keep it separate: Encourage your child to hold the gift in their name only and avoid using it for the matrimonial home or joint investments.

- Put it in writing: Work with a lawyer to clearly document that the gift is intended for your child alone.

- Consider added protection: For larger gifts, your child may want to enter into a marriage contract. Alternatively, you may consider using a trust structure to help keep the asset separate from marital property.

Giving: Generosity With Benefits

Whether you donate during your lifetime or leave a gift through your estate, charitable giving reduces the size of your estate and offers valuable tax benefits, while supporting causes that matter to you.

Donating During Your Lifetime

When you give while you’re alive, you not only see the impact of your generosity, you may also benefit from two key tax advantages:

- Donation Tax Credit (DTC): Charitable donations can earn you a tax credit for up to 75% of your net income in a given year, helping to lower your overall tax bill.

- Elimination of Capital Gains Tax: When you donate publicly traded securities (like stocks or mutual funds) that have appreciated in value, you avoid paying capital gains tax on the growth, and still receive a donation receipt for the full fair market value. This makes giving securities one of the most tax-efficient ways to donate.

A Word of Caution: Recent changes to the Alternative Minimum Tax (AMT) rules may reduce the after-tax advantage of certain donation strategies. As outlined in our December 2023 blog, those with substantial tax-preferred income (such as dividends and/or capital gains) who also make large donations of cash or securities may find themselves subject to AMT exposure, potentially diminishing or eliminating their expected tax credit benefit. With thoughtful planning however, those affected can still contribute to their chosen causes and benefit from tax relief.

Donating Through Your Will

Leaving a gift to charity in your will is a meaningful way to create a lasting legacy. It also brings important tax relief: your estate can claim donation tax credits for up to 100% of your final year’s net income, potentially offsetting taxes on capital gains from investments, a family cottage, or other assets.

Here are a few things to keep in mind when planning a charitable bequest:

- Be precise: Name the charity accurately and include its full legal name and charitable registration number.

- Plan for the unexpected: Consider naming an alternate charity or giving your executor discretion if the organization no longer exists.

- Talk to the charity. Many charities have legacy-giving teams who can help you craft the right language for your will and offer guidance on how to make your gift as impactful as possible.

Bottom Line: Giving during your lifetime – whether to family or charity – can be rewarding and strategic. With the right planning, you can reduce taxes, support meaningful causes, and see the impact of your generosity in real time.

Next Steps: The Smooth Hand-Off

This is just the beginning when it comes to smart, tax-efficient ways to pass on your wealth, and every family’s situation is unique. That’s where your Nexus Wealth Planners come in. We’re here to start the wealth transfer conversation, offer a sounding board, and share ideas to help you move forward with clarity. While your estate lawyer will give legal advice and draft the necessary documents, we’re always happy to collaborate with them (and any of your other trusted advisors) to ensure your plan is thoughtful, coordinated, and truly reflects your wishes. With the right support and planning today, you’ll be well on your way to a smooth hand-off tomorrow.